20 Great Ways For Choosing AI Stock Prediction Websites

20 Great Ways For Choosing AI Stock Prediction Websites

Blog Article

Top 10 Suggestions For Evaluating The Cost And Pricing Of Ai Trading Platforms For Stock

Assessing the cost and pricing of AI software for predicting and analyzing stocks is crucial to ensure you get the most for your money without incurring hidden costs or unanticipated expenses. Knowing the pricing structure is essential to make an informed choice. Below are the top 10 suggestions for evaluating the price and costs of these platforms:

1. Learn about the pricing model

Subscription-based: Determine if the platform charges either a monthly or an annual cost, and also what features are offered at each tier.

Pay-per Use: Verify whether the platform charges on usage (e.g. amount of trades completed and data requests made, or forecasts).

Freemium model: Determine whether the platform provides a free tier with limited features and charges for premium features.

2. Compare Pricing Tiers

Feature breakdown: Compare what features are offered in each pricing the tier (e.g., basic, professional, or enterprise).

Scalability: Ensure the pricing tiers you choose to use are compatible with your requirements, whether you're an individual trader, a professional, or an institutional member.

Upgrade flexibility: Find out whether you are able to easily change or upgrade your plan when your needs alter.

3. Evaluate Hidden Costs

Fees for data. Check if the platform is charging a fee for accessing premium data.

Brokerage fees - Make sure for any additional charges are imposed by the platform for execution of trades, or integration with brokers.

API usage: Determine whether there are additional costs for API access or frequent API usage.

4. Try out demos for free and trial versions

Trial period. Look for platforms offering the option of a demo or trial so that you can try their services before committing.

Limitations of the trial: Make sure that it is inclusive of all features or if there are limitations regarding the functionality.

If the platform is not the right fit for you, then make sure you are able to cancel the trial.

5. Find out about discounts and promotions.

Discounts for annual plans Find out what you can avail as an annual discount plan, compared to the monthly.

Referral programs: Check whether you can earn discounts or credits by making others aware of the platform.

Bulk or Institutional Pricing If your company is large it is possible to ask about bulk and institutional pricing.

6. Calculate Return on Investment

Cost vs. Value: Find out if the capabilities and forecasts of the platform are worth its price. Does it help you save time, or help make better decisions in trading?

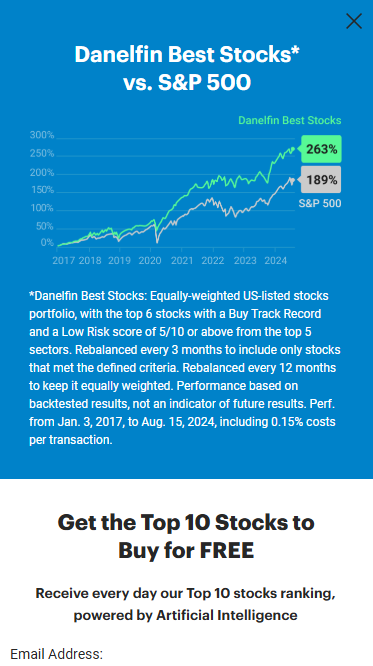

Track record of performance: Study the platform's success rate or user reviews to assess the potential return on investment.

Alternative costs - Compare the platform's cost to the possible cost if you don't use it (e.g., missed opportunity, time spent on manual analysis).

7. Review and review cancellations and refunds Policies

Cancellation Terms: You can cancel without hidden charges or penalties.

Go through the refund policy to see whether you are eligible for the refund you need for non-used subscriptions.

Auto-renewal: Verify that the platform is automatically renewing your subscription, and how you can decide to stop it.

8. Review Transparency of Pricing

Clear pricing page: Make sure whether the platform has a pricing page which is complete, transparent and doesn't include any hidden fees.

Customer Support: To clarify unclear pricing information and other charges, call customer support.

Contract Terms: Know the long-term obligations and penalties, by reading the contract's clauses.

9. Compare to Competitors

Comparing features and prices of different platforms is an excellent method to ensure you're getting a good deal.

Feedback from users: See what others think of the platform and determine if it is worth the price.

Market positioning: Find out whether it is priced as a premium, mid-tier, or a budget choice and if it aligns with your expectations.

10. Assess the long-term costs

Price increases: Find out whether there is a consistent pattern of price increases and the frequency at which they occur. frequently they occur.

Additions to your plan: Determine if you need an upgrade, or if the latest features are included within your existing plan.

Scalability costs - Make sure that the platform's price remains affordable, even if your trading volume or data requirements increase.

Bonus Tips

Try out multiple platforms. Try them all out with a no-cost trial to test their performance.

Set your prices in advance. If you're a part or a larger institution or if you use the product in large quantities, discuss pricing options that are custom.

Look for free educational tools and sources. Some platforms provide educational tools or resources that are complimentary.

Following these tips can help you evaluate the pricing and costs of AI stock-predicting/analyzing trading platforms. It is possible to pick one that is suitable for your budget, while providing the features you need. A well-priced trading platform will strike the right equilibrium between affordability and features which will help you maximize your success. Have a look at the top rated best ai trading app for blog info including ai trading tools, trading with ai, trading with ai, investing ai, stock ai, chart ai trading assistant, ai trading tools, chatgpt copyright, chart ai trading assistant, ai for stock predictions and more.

Top 10 Ways To Evaluate The Updates And Maintenance Of AI stock Trading Platforms

It is important to assess the maintenance and updates of AI-driven stock prediction and trading platforms. This will guarantee that they're secure and are in sync with the changing market conditions. These are the top 10 tips to analyze their maintenance and updates:

1. Updates are posted regularly

Find out the frequency of updates that are made (e.g. every week, each month, or once a quarter).

Why? Regular updates demonstrate active development and responsiveness towards market changes.

2. Transparency in Release Notes

Review the release notes for your platform to find out what improvements and changes have been made.

Transparent release notes show that the platform is committed to continuous advancement.

3. AI Model Retraining Schedule

Tips Ask what frequency AI is retrained by new data.

The reason: Models need to evolve to stay accurate and relevant as market dynamics change.

4. Bug Fixes & Issue Resolution

Tips: Find out how quickly the platform reacts to problems or bugs users report.

The reason bugs are fixed as soon as possible in order to make sure that the platform remains stable and reliable.

5. Security Updates

Tips: Make sure that the platform has updated its security protocols on a regular basis to ensure the security of data of users and trading activities.

Why is that cybersecurity plays a critical role in the financial services. It assists in protecting against hacking and other breaches.

6. Integration of New Features

Go through the platform to determine if it has added new features that are based on user or market feedback (e.g. an enhanced analytics).

The reason: The updates to feature features demonstrate creativity and responsiveness to the needs of users.

7. Backward Compatibility

Tips: Ensure that updates don't interfere with existing functionality or require significant configuration.

What's the reason? The software's backward compatibility makes sure that the software can be used with ease.

8. Communication with Users During Maintenance

Think about examining the manner in how your platform communicates to users of scheduled maintenance or outages.

Clare communication reduces disruptions, and builds trust.

9. Performance Monitoring, Optimization and Analyses

Tips: Make sure that the platform is continuously monitoring performance metrics (e.g. latency, latency, accuracy) and optimizes its systems.

The reason is that ongoing improvement can ensure that the platform stays effective.

10. Conformity to Regulatory Changes

Verify if the platform been updated with its policies and features in order to be compliant with any new data privacy laws or financial regulations.

Reasons: Regulatory compliance is crucial to reduce legal risks and maintain confidence in the user.

Bonus Tip User Feedback Integration

Check if the platform actively integrates feedback from users into its updates and maintenance processes. This shows a method that is based on user feedback and a determination to improve.

You can look at these elements to make sure you are selecting a platform for AI prediction of stocks and trading that is up-to current, well-maintained, and able to adapt to the ever-changing dynamics of the market. Read the recommended best ai trading platform info for more tips including best ai penny stocks, ai options, ai share trading, free ai tool for stock market india, stock trading ai, free ai tool for stock market india, ai share trading, AI stock analysis, best stock prediction website, ai copyright signals and more.